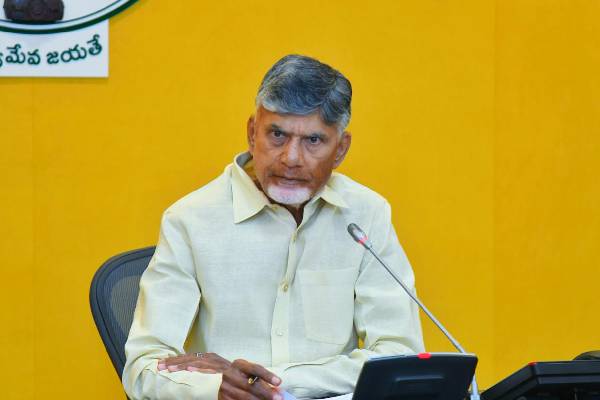

The GST rates on 30 items of mass consumption were slashed on Saturday while the cess on mid and high-segment cars went up by 2 to 7 per cent as the GST Council formed a five-member Committee to sort out technical glitches faced on the return-filing portal while the last date for GSTR 1 has been extended by a month.

Briefing the media after the second review meeting post the Goods and Services Tax roll out, Union Finance Minister Arun Jaitley said that in consonance with the recommendations of the fitment committee, the tax rates on approximately 30 goods of common utility, including dry tamarind, custard powder, raincoats, rubberbands and batter for idli and dosa, have been reduced.

The pre-GST rates on some of the items were also slashed. The tax on plastic raincoats and rubberbands, for instance, have been reduced from 28 to 18 and 12 per cent respectively.

Jaitley with the changed nature of economy, the government could afford to have the rates of some these items reduced.

Khadi fabric through Khadi and Village Industries Commission Act of 1956 (KVIC) stores will now be exempted under GST.

About the increase in cess rates on automobiles, he said that while status quo has been maintained for small cars (petrol and diesel), hybrid cars and 13-seater vehicles, the Council decided to increase the cess rates for some segments.

GST cess on mid-segment cars has been increased by 2 per cent, for large segment cars it has been increased by 5 per cent and for SUVs by 7 per cent, he said. He claimed that though the space of increase was 10 pe rcent, the Council did not restore the pre-GST rates.

Jaitley said in view of the GST filing portal encountering increasing technical glitches, the Council has decided to set up a five-member ministerial panel to oversee its functioning and smoothen the process.

The return filing date deadline of GSTR-1 for July, that was to end on Sunday, has also been extended by a month till October 10.

“Since the work is huge, the Council decided a new schedule itself for filing returns. Because of the load on the system, we want to give adequate time to taxpayers,” Jaitley told reporters after the meeting.

“There are transient challenges in technology. The Council decided to appoint a committee, the composition of which will be announced in a day or two. It will consist of ministers who will interact with GST to ensure a smooth transformation,” he said.

The decision was taken after the Council reviewed the functioning of the GST Network (GSTN) platform. A detailed presentation was given to the members by GSTN officials.

Jaitley said the portal did face technical glitches on two-three occasions due to overload.

The eight-hour long meeting was the 21st meeting of the Council.

The council also decided that food items sold under a trademark registered as on May 15, 2017 and also under a name on which exclusivity can be claimed by actionable claim, 5 per cent GST will be charged.

Jaitley said this was done to do away with the disparity created in the trade, as some of the food items sold in open categories had zero GST while branded and packaged had five per cent. He said a section of food industry was getting their registered trademark deregistered and was selling the food items either under a deregistered trademark or under corporate name.

A detailed presentation was with regard to migration of old registrants to GST from earlier regime. On GST revenue collections and distribution of money to the states, he said though the overall collection has been quite robust with more than 70 per cent of the eligible registrants for July filing, the figure of approximately Rs 95,000 crore for July was paid and some spillover of VAT collections of June were also be added

Jaitley said that there is still a very large unutilized IGST, which is used as credit for payment of CGST and SGST and for July out of Rs 48,000 crore IGST, approximately Rs 10,000 crore was adjusted between the Centre and states. He said Rs 37,000 crore is still lying which will be used in subsequent months.