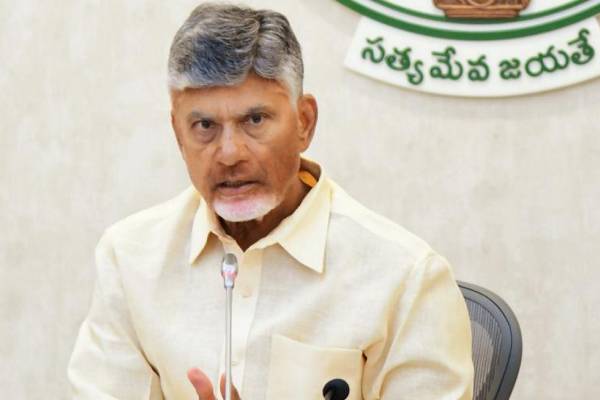

The prime minister has struck a chord with the poor

India economy has been the pride of world. It has been showcased as the only growing economy – a proud moment for Indians particularly under Prime Minister Narendra Modi.

However a section of media and political parties differ. There have been some stories in the foreign media also sceptical of the decision. Has the worldview changed? Is that correct?

But despite all this, one surprising aspect is quite visible that those standing in the queues or facing the sudden withdrawal of cash are vocally supporting the decision and seem to be fully in agreement with Prime Minister Modi that this would prove to be a decisive step to eliminate corruption and black money from the country.

Demonetisation was never dreamt to be an option to fight black money, terror funding or money laundering. It is an out of the box solution. It led to a withdrawal of over Rs 14 lakh crore currency notes or 84 percent in circulation. It led to a sudden thaw in many activities, queues at banks and ATMs.

But surprisingly those in the lower end of the economy almost in unison said that they were not unhappy as those having stacks of untaxed money have huge suffering.

The prime minister has struck the chord with the poor. India’s poor are the happiest today. They feel they have found a leader who really cares for them. They also feel that most leaders make poll promises, but at least one delivers it. As the penalties on undeclared income are now considered to be enhanced and the huge sum is to be used for development and poverty alleviation.

This explains why despite so much of hullaballoo, the nation continues to function in a quiet atmosphere. It is a period of transition and everybody wants to be at the right side.

It is no wonder that Rs 8.5 lakh crore demonetised notes have come back to the bank coffers till November 24. The bankers say it is over 55 percent of what was in circulation. Only Rs 33000 crore worth notes are exchanged.

The new currency in circulation is about Rs 1.36 lakh crore. There remains a huge cash shortage. That is reflected in the continuous demand at banks as their stacks are to be filled with new notes. The problem persists in the market as well.

It has led to emergence of new credit system at localities, villages and even in the farm market. That is a partial relief.

Indian market system relies on cash transaction. The wholesale business works on a low cut of 1 to 1.5 percent and cash deals help in fast turnover. The cash also has its problem. There is a perception that it leads to evasion of tax and consequent creation of black money.

The prime minister in his Man ki Baat on November 27 gave a call to go cashless and transact through various electronic modes, bank transfers, cheques and e-wallets.

It is a plausible system. There are over 71 crore debit cards and 2.6 crore credit cards. Considering that many have multiple cards, the actual may be around 65 crore cards. Over 80 crore people have mobile phones, which can work also as a wallet. The wallets are being used by the youth and it is solving the problem of small coins as well.

The people are still less comfortable with electronic transfers. They are apprehensive of security issues. The banks recently blocked six lakh debit cards as they said the data were compromised. This also increases the concerns. An e-wallet also has to suspend operation recently as the authorities pointed out to certain shortcomings in its security systems.

In many cases people avoid it as the sellers demand an extra payment of 2 to 2.5 percent for card usage. Besides, the payments stations (POS) are also not available everywhere. Of late, there is a demand and now the banks that over 5000 such demands have been placed with them.

It takes time to solve the issues. If these are solved the chances of using the e-payment system is likely to increase. The government is trying to remove the bottlenecks. During the last over 20 days the usage of e-payments have increased.

Banks have come out with massive advertisements – cash nahi to hum hai na. They have also launched micro ATMs to popularise the e-payment option.

No society however is cashless. The people need to listen to the prime minister. He also says that let it be less cash. The cashless system has a cost that either the banks have to bear or the customer. The banks are finding dealing not easy with huge cash arrivals. The RBI has also understanding the problem of high liquidity with banks has increased the cash reserve ratio (CRR).

The country also has to reduce the tax rates and the bureaucracy and bankers have to be more understanding and rational. An economy that is in cash going to less cash and then cashless would take some time. It can happen gradually. The expanse of the country is vast and there are also problems in remote areas and hinterlands. There has to be a mix of all the different payment modes. One system alone would not suffice and could have its problems as well.

And finally howsoever critical the opposition or section of media might be, despite problems, India is poised for growth.