The union government has created an email to facilitated citizens to directly contact the finance ministry with information about possible conversion of address: blackmoneyinfo@incometax.gov.in.

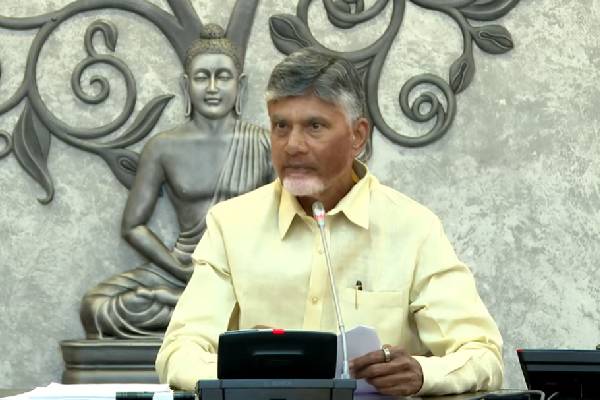

Revenue Secretary Hasmukh Adhia announced that unaccounted cash can be disclosed under Pradhan Mantri Garib Kalyan Yojana (PMGKY) from December 17 2016 till March 31 2017. Under this scheme, 50% tax on bank deposits of junk currencies made post demonetisation. . He cautioned this will be the last chance to disclose black money.

He cautioned that not declaring the black money under the scheme now but showing it as income in the tax return form would lead to a total levy of 77.25 per cent in taxes and penalty. In case the disclosure is not made either using the scheme or in return, a further 10 per cent penalty on tax will be levied followed by prosecution.

Adhia further stated that receipt of tax paid on deposits will have to be shown to avail disclosure scheme benefits including immunity from prosecution. He emphasised that mere depositing of cash in banks will not convert black money into white. Taxes have to be paid first and then the scheme can be availed on production of tax receipt, unlike the recent Income Disclosure Scheme and other such plans wherein disclosures were made first and taxes were recovered later.

He said that the government wants people to join PMGKY and through this scheme, contribute to the welfare of people. He stated that the declarations made under this new black money disclosure scheme will be kept confidential and the information would strictly stay with the department. “Don’t want inspector-raj to affect people, the people should understand that all information about their deposits is with the department,” he added.

The government, said Adhia, through the Financial Intelligence Unit (FIU) is getting data about every single deposit in bank account. Also, Income Tax, Enforcement Directorate and other investigative agencies are keeping a close watch on the information.