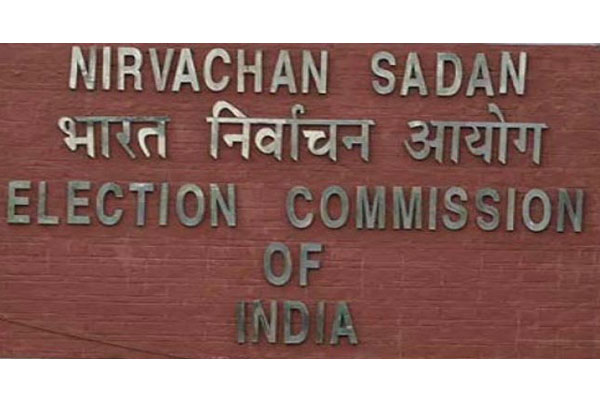

In a major setback to political parties, who have been seems to be united in preventing `financial transparency’ in their organisational set-up, the Election Commission (EC) has sought the government to amend laws banning anonymous contributions of Rs 2,000 and above made to political parties.

This recommendation of the EC gains significance in the background of government’s yesterday decision that political parties depositing old Rs 500 and Rs 1,000 notes in their accounts will be exempted from income tax, provided the donations taken are below Rs 20,000 per individual and properly documented.

The EC has also proposed that exemption of Income Tax should only be extended to political parties that contest elections and win seats in Lok Sabha or assembly polls.

There is no constitutional or statutory prohibition on receipt of anonymous donations by political parties. But there is an “indirect partial ban” on anonymous donations through the requirement of declaration of donations under section 29C of The Representation of the People Act, 1951.

But, such declarations are mandated only for contributions above Rs 20,000. As per the proposed amendment, sent by the Commission to the government, and made part of its compendium on proposed electoral reforms, “anonymous contributions above or equal to the amount of Rs 2,000 should be prohibited.”

Further, the EC has also seek the law to ensure that political parties are made to register details of donors for coupons of all amounts on the basis of a Supreme Court order of 1996. Coupons are one of the ways devised by the political parties for collecting donations and hence are printed by the party itself. There is no cap or limit as to how many coupons can be printed or its total quantum.

Currently, the details of donors is not required for coupons with small amounts such as for Rs 10 or 20. “These smaller sums aggregate into a bigger amount and hence, they need to be accounted for, to ensure transparency,” the EC added.