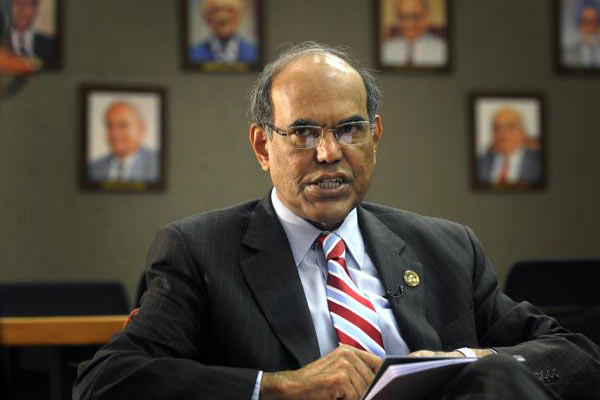

Former RBI Governor Duvvuri Subbarao deplored that the objectives of Prime Minister Narendra Modi’s ambitious demonitisaiton of high value currency notes are not yet clear and remains a puzzle for economists of the country.

Speaking at a panel discussion on ‘The Role of Reserve Bank of India (RBI) in Demonetisation’, organised during the ongoing 28th annual book festival in Vijayawada, he strongly felt the need that the Centre should give clarity on the objective behind this move.

Moreover, he deplored that presently people are more worried about the safety of their hard-earned money in this digital world. He recalled that the Centre initially stated that the note ban was aimed at curbing counterfeit currency. Sometime later, it announced that the move was targeted at black money. Again, it avowed that demonetisation was aimed to tackle terrorism and then said, it was meant to promote cashless economy.

In all, Subbarao said that there is no clarity in the Centre’s statements. He further added that no one knew as to how much black money exists in the country and the estimated figures were apparently not correct. The financial experts, too, had no clue with 86 per cent of currency in circulation being declared as invalid.

Rao asserted that the role of RBI is not only to print and issue currency, but its primary responsibility also is to control inflation, improve the growth rate and maintain financial stability in the country. Though India is lagging behind in cyber security aspects and moving ahead with weak financial payment gateways, the RBI is regularly monitoring the financial payment gateways and ensuring security, he added.