Union Budget 2016-17

Vidyuth Chikoti

As the Union Budget 2017-18 will be presented on February 1st 2017, we will be witnessing an array of discussions on the Budget and one will be hearing a lot of buzz words like GDP, Fiscal deficit, Revenue Receipts etc. So, this writeup is an attempt to better understand some of the basic concepts for all laymen like me.

What is GDP? GDP or Gross Domestic Product is one of the most used indicator in gauging the health of a country’s economy. To put it very simply a GDP represents the size of the economy and it is calculated over a period of time be it a year or quarter. It is usually expressed as a percentage of growth from previous year. For example, if a Country has 5% growth in GDP compared to last year, that means economy of that country is supposed to have been grown by 5 % this year. The calculation of GDP can be done in multiple ways but the most commonly used method is the expenditure method. In this method, the GDP is calculated by adding total Government spending, total consumption, exports minus imports. So, if the GDP of a country is increasing year on year that means the economy is improving and if there is decline the economy is on a decline. To put it in formula:

GDP = G+C+I+NX.

G= Government spending (On wages, spending on various departments etc)

C= Private and Public Consumption (This includes everyday consumption of food items, agriculture related consumption etc)

I=Total investment in the country including the Business capital expenditure. ( Either domestic or Foreign investment on a business/company)

NX= (Exports-Imports)

To understand GDP in a more intuitive way, Imagine that in the current year Agriculture sector had a production higher than last year, this means that food consumption is higher which would mean the Farmers spent more money on Seeds, wages for workers, fertilizers etc. this also reflects people of the country have spent more money on food (C). This means the farmers have lot more money to spend and this would result in them purchasing consumer products like T.V’s,

Scooters etc.(C). This means the companies which produce these goods have grown and further invest in that country (I) and pay higher taxes to Government which would enable the Government in higher Spending (G). As you can see GDP is a good indicator of the health of economy.

Nominal vs Real GDP : In the calculation of GDP if inflation is not accounted, then it is Nominal GDP. The calculation of GDP after adjusting the inflation is called as Real GDP.

What is Fiscal Deficit ?

To put it simply Fiscal deficit represents the Debt of a country.When the Government expenditure is more than the revenues it generates Fiscal deficit occurs. Fiscal deficit is the difference between the Government expenditure and its Revenues excluding the money the Government borrowed. Fiscal deficit is presented as a percentage of GDP. Fiscal Deficit is another important economic indicator based on which many foreign investors, Rating Agencies decide whether or not to invest in that country or not. A high fiscal deficit is considered not good for the economy because it shows that country has high expenditure and low revenues and the money for the expenditure is coming from borrowings.

Where does the Government get its money from ?

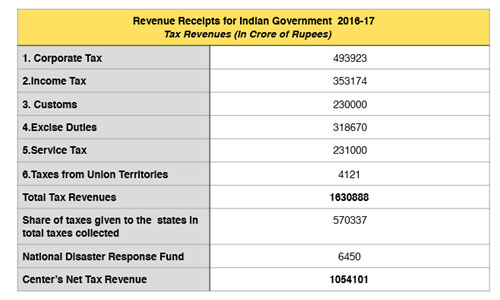

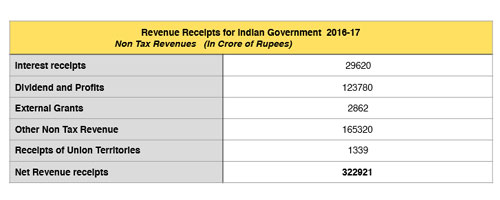

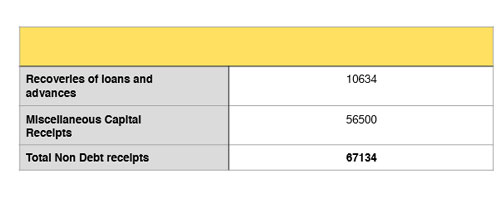

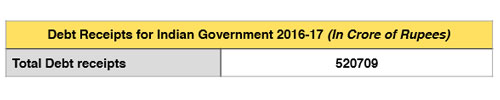

Lets consider the data for Indian Government in the year 2016-17 :

1. Taxes Revenues ~ 10.5 Lakh crore

2. Non- Tax Revenues ~ 3 Lakh crore

3. Capital Non- Debt Receipts ~ 67,134 Crores

Total income for Indian Government = Center’s Net tax Revenue + Net revenue Receipts + Total Non Debt Receipts = 14,44,156 (~ 14 Lakh crores)

The Other Source of Income for the Center is through Loans and Debts which causes the Fiscal Deficit :

4. Debt Receipts ~ 5 Lakh Crores

The Total Budget Resources = 1978060 Crores (~ 19 Lakh crores)

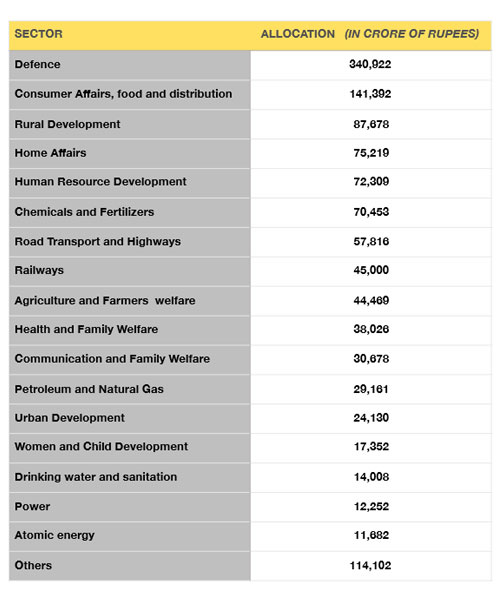

Where does the Government Spend its Money ? Let’s see in 2016-17 what are the major areas the Government spent its money:

From above data, we can see that major chunk of the Money is being Spent on Defence, Subsidies (PDS), Infrastructure but very less is being spent on Education and Healthcare.

Fundraiser Results by Salesperson

From above data, we can see that major chunk of the Money is being Spent on Defence, Subsidies (PDS), Infrastructure but very less is being spent on Education and Healthcare.

Budget 2017-18:

As you can see the major share of money generated to government is through direct taxes and more the Compliance of tax payers in India the Government will have more liberty for spending it on various Infrastructure projects and Welfare schemes, without increasing Fiscal burden of the nation. With this understanding of some of the Budget terminology and the numbers of 2016-17 hope you all can compare and better understand where and how the money is being spent in Budget 2017-18.