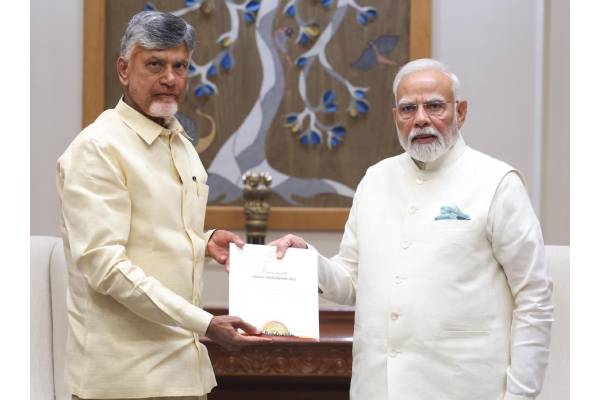

The chairman of Annapurna Hotel in Coimbatore recently sparked a heated debate about GST rules. During a meeting with Finance Minister Nirmala Sitharaman, he questioned why bread isn’t taxed but cream fillings are. This conversation quickly went viral on social media.

After the incident, the hotel chairman apologized to the Finance Minister. The BJP shared a video of his apology, which led to comments from various political parties. BJP state president Annamalai later said sorry for sharing the video.

Annapurna Hotel saw a chance to turn this situation into a marketing opportunity. They created a new ad featuring “Bun and Cream” and shared it on social media. At first, they used hashtags like #GST and #StandWithAnnapurna, but later removed them.

This event has led to wider discussions about how GST affects small businesses. It shows that tax policies can have unexpected effects on different industries.

Mean while in Telangana’s tax department has found over 1,800 possibly fake businesses among its GST-registered dealers. This discovery is part of a bigger plan to make sure businesses pay their taxes correctly.

The state has 5.33 lakh GST-registered dealers. About 2 lakh of these do more than 1.5 million business deals each year. The government is now watching these transactions more closely, especially for businesses that make over 5 crore rupees a year.

This closer watch has already shown results. In August 2023, Telangana collected 6,051.04 crore rupees in taxes. This is 10% more than the same month last year, an extra 552.62 crore rupees.

The tax department is taking strong action against businesses that don’t follow the rules. They’ve checked about 700 businesses in person and found about 100 fake companies. So far, they’ve taken back over 150 crore rupees from these fake businesses.

If companies have taken money wrongly through input tax credit (ITC), the government plans to take their property. They’re also thinking about other ways to punish those who break the rules.

Experts think that if the tax department keeps watching closely, they’ll collect even more money in taxes. This could help the state’s finances a lot.

-Sanyogita