Telangana government is known to partner with startups for government apps. This time it gave an opportunity to finance startup Transaction Analysts to create its T-wallet app. The app is available for download for Android and iOS platforms. As the app was released on Thursday do not expect it to be free of errors. Specifically, latency issues, frozen screen and messages like “error occurred. Please try again later” or “server Error”. Nonetheless your money is safe. Since the app is new-fangled, hopefully these bugs will be apparently rectified in subsequent updates.

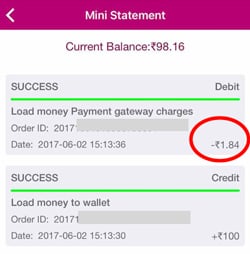

The first thing a user notices when they add money to their T-wallet account, is the payment gateway charges. So, if you add say Rs 100 to your account using net banking, Rs 1.84 will be deducted. This will not be appreciated or for that matter accepted by the users. Especially when private wallets like Paytm are providing services without payment gateway charges and also give away cashbacks and coupon codes.

The first thing a user notices when they add money to their T-wallet account, is the payment gateway charges. So, if you add say Rs 100 to your account using net banking, Rs 1.84 will be deducted. This will not be appreciated or for that matter accepted by the users. Especially when private wallets like Paytm are providing services without payment gateway charges and also give away cashbacks and coupon codes.

Minister K T Rama Rao claimed that BHIM is only for personal transactions but using T-wallet app people can make government transactions as well. A major advantage with BHIM is it directly connects to bank accounts and there is no payment gateways and burden of adding money to the wallet. If one has more than two bank accounts the details can be retrieved on the same app.

It is said that the wallet will support the citizens with receipt of government benefits like pension, scholarships, MNREGA wages and others. So most likely the money will be transferred as mcash and then the customer needs to transfer it to their bank account. The IMPS transaction limits are set as per RBI guidelines, so if any incentive is greater than 5000 rupees for a non-KYC customer and 10000 rupees for a KYC customer, there will be service charges.

Currently almost all the banks offer its customers with a facility for standing transactions to pay utility bills like electricity, gas, water and also private bills like DTH, landline, Internet etc. A lot of marketing is needed for this existing user base to switch to T-wallet. One major advantage using this wallet is that there is no transaction charge for paying electricity bill. One can pay it using the app, or visit the electricity website and select the option t-wallet at payment. For RTA related payments, visit the page as there is no option in the app directly. Surprisingly when you apply for Learner License online with RTA, at the payment page there are two wallets, one Paytm and other T-wallet.

Its integration with government departments such as MeeSeva, GHMC, HMWSSB, RTA will be beneficial. Currently it offers only Electricity, Waterbill and GHMC icons in the government bills section. However, the GHMC assimilation is likely to be released in subsequent updates.

T-wallet is similar to Paytm and an easy UI with government services as a value add. However, Paytm has already penetrated into market. The launch of the app is late particularly when there is tough-competition in the cluttered e-wallet space with players like Paytm, PayUmoney, State Bank Buddy etc. However, the minister said about 1.2 lakh merchants have been enabled and awareness has been created among 7 lakh people as part of the project. The government may want to waive-off payment gateway charges for encouraging general public to use the T-wallet app.