Petroleum is the taxation milch cow for the central and the state governments and it is unlikely to be brought under the Goods and Services Tax (GST) any time soon.

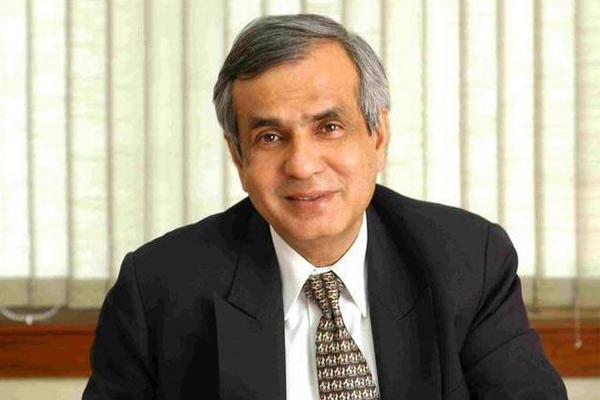

That’s also the view of the Vice Chairman of Niti Aayog, Rajiv Kumar. Several senior ministers have demanded that petroleum products — basically petrol and diesel — be brought under the the new taxation regime.

But says Kumar: “It (oil) can’t be brought under GST. That’s because the total state and central taxes on petrol put together are around 90 per cent right now.”

He told IANS in an interview here: “I can’t see how any state will take a cut so huge as the highest rate under the GST is 28 per cent. A new GST band will have to be opened up — and that will be an enormous exercise.”

While supporting “in principle” the idea of bringing all items under the new indirect tax system, he said those talking about doing it now have not thought this through.

“The better way to do this is to first start reducing taxes (on petroleum products) as I have said many times in public. States impose ad-valorem tax on oil and so they all had a windfall gain (when prices rose). There is a need to rationalise it,” he said, adding “states should especially cut taxes.”

Kumar said that both the central and the state governments should start the process of weaning themselves away from their dependence on oil taxation.

According to him, the Central government collects Rs 2.5 lakh crore as tax on oil while almost Rs 2 lakh crore is collected by the states. “From where will they compensate it?” he asks adding that if the taxes are reduced gradually, the burden on the economy will get reduced.

“Higher oil prices are like a tax on the economy. If oil prices are brought down, economic activity will also improve,” Kumar said.

“Once that is achieved, once the revenues have gone up from other sources and the economy has picked up, then you can think of bringing oil under GST. It’s not that easy,” he added.

Ever since the new tax legislation was rolled out on July 1 last year, there had been talk of bringing it under the GST with top government officials and ministers supporting the need for such a move. The Opposition parties, of course, have been clamouring for it.

In December last year, Finance Minister Arun Jaitley had told the Rajya Sabha that the Central government was in favour of bringing petroleum products under the ambit of GST after building a consensus with states.

More recently, in April, when the international crude oil prices were going up sharply, pushing the domestic petrol prices to record levels, BJP President Amit Shah told a rally in Mumbai that efforts were on to bring petrol and diesel under the GST.

From Road Transport and Highways Minister Nitin Gadkari to Petroleum and Naural Gas Minister Dharmendra Pradhan, almost every senior BJP minister has favoured bringing petroleum products under the GST.

Among states, Maharashtra Chief Minister Devendra Fadnavis has also expressed willingness to bring petrol and diesel under GST in his state if a consensus was brought about on it.

Kumar says he was in favour of such a change, but it has to be thought through in practical terms.

“I am just simply saying that let’s not try to hurry it because you would only run into problems as there is a huge dependence on oil,” he said.

“Even electricity should be brought under GST. Everything should be under GST. But I am not sure whether it is worked out yet. Let’s agree to bring it under GST but over a period of time as is practical,” he said.

Click here for part NITI Aayog Vice Chairman Rajiv Kumar Interview Part 2