What is GST? GST, touted as the biggest tax reform in the independent India, is likely to pass in the Rajya Sabha today, and the current dispensation is planning to implement it from 1st April, 2017.

GST is a tax applicable to the supply of goods and services, and no distinction is made between them goods and services, and none of them are exempt from GST. The intent of implementing GST is to improve the compliance, reduce the tax burden on the consumers by eliminating the ‘tax-on- tax’ imposed on the goods and services, and consolidate several Central and State taxes. Once GST is implemented, the tax burden on consumers is estimated to reduce by 25–30% and GDP is estimated to increase by 0.9 to 1.7%.

Benefits for the business

GST is a much-needed reform to those who perceive running businesses in India as a nightmare. GST promises to eliminate the cascading burden of existing taxes on the businesses, decrease the compliance costs through uniformity of tax rates and procedures across the country, and phase out the Central Sales Tax to make the domestic businesses globally competitive. Indeed, the GST will improve the ease of starting, operating, and expand the businesses in India.

Impact on the consumers:

Once the GST is rolled out, the elimination of multiple taxes will lead to lower prices of goods and services, and is bound to benefit the consumers in the long-term. On inflation, the Arvind Subramanian, Chief Economic Adviser (CEA), cautioned spike in prices initially, and optimistic about no impact of GST on inflation, and the price levels in the long-run. An experience from Malaysia and Australia validates these claims — over a year after implementation of GST, the inflation returned to normal rates, and at 6% GST rate, the consumer price index is expected to decrease by 10%. In Australia, GST had no impact on average price changes.

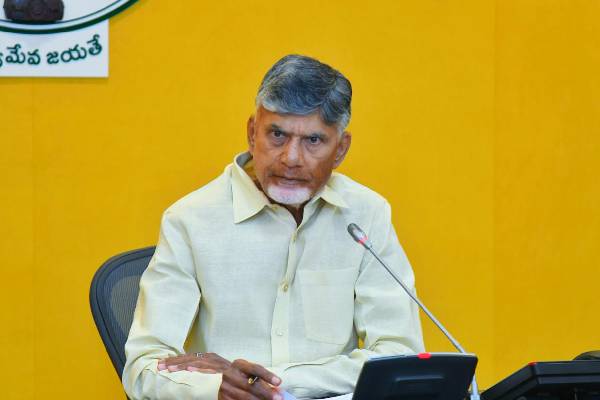

Implications for Andhra Pradesh:

The implementation of GST has three major implications for Andhra Pradesh

- First, the concerns about revenue loss. After the bifurcation, Andhra Pradesh has become a revenue deficit state, and the introduction of GST is estimated to cause a revenue loss of Rs 4,700 crore to the state. Though the Union of India has promised to compensate any such loses to the states for 5 years, the Union has a history of delaying the transfer of funds. This may impact the development and welfare activities in the state. The Government of AP is expected to accurately estimate the loss of revenues, and ensure time-bound compensation of these losses from the Union.

- Second, on the growth of MSMEs. The lower industrial footprint has prompted the Government of Andhra Pradesh (GoAP) to roll out several incentives to attract the Micro, Small and Medium Enterprises (MSMEs) to the state. 100% exception on Value Added Tax (VAT), Central Sales Tax (CST), and State Goods and Service Tax (SGST) are provided for a period of first five and seven years for MSEs and medium-sized enterprises respectively. VAT, CST and SGST will be subsumed into the proposed GST. Once the GST is rolled out, the issues arising out of implementing the GoAP’s incentives may affect the MSMEs activities in the state. Addressing the issues due to the states’ tax incentives to MSMEs while implementing GST should be a priority for GoAP.

- Third, the promising growth of electronics manufacturing sector. Niti Ayog noted that GST provides an impetus for the growth of electronics manufacturing in the country. Electronics manufacturing is a special focus area in the industrialisation strategy of GoAP, and the earlier implementation of GST will boost the GoAP’s efforts to attract the industries in this sector in Siri City SEZ, and proposed electronics manufacturing cluster in Visakhapatnam.

“Andhra Pradesh will welcome the GST in the interest of the nation, even though there will be loss of revenue to the state” Yanamala Ramakrishnudu, the Finance Minister of AP

— Revendra